Pakistan Private Sector Energy Project Final Report

-

PPSE

2021-2024 - 46.34 Total investment mobilised (USD million)

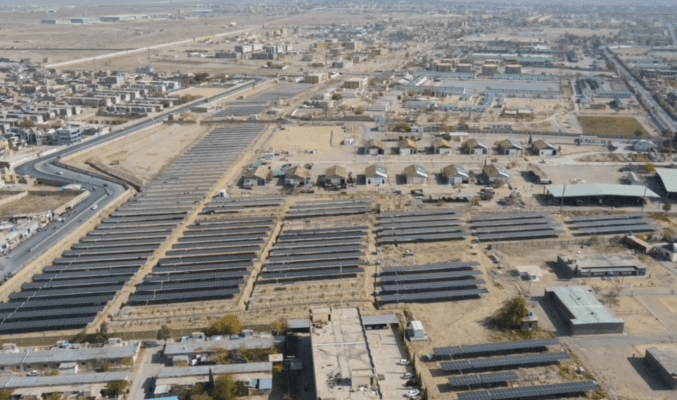

- 63.1 Clean energy capacity added (MW)

- 73 Total projects supported by PPSE

- 15 Total projects which mobilised finance

- 21 Projects which mobilised finance (%)

- 358,883 Potential CO2e emission mitigation (megatonnes/year)

The Pakistan Private Sector Energy Project

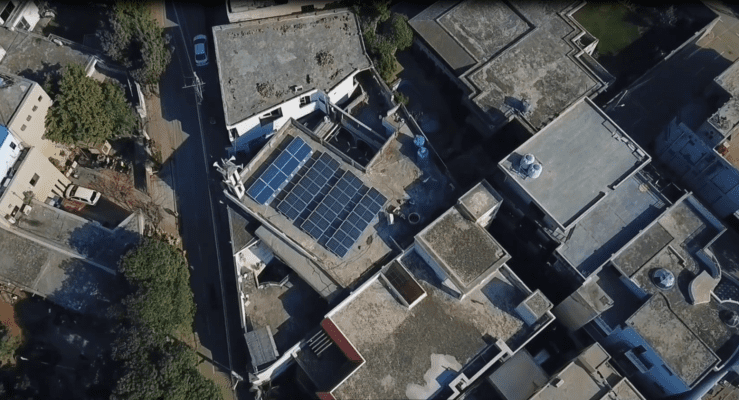

PFAN was founded in 2006 to support clean energy and climate entrepreneurs with great ideas who lacked the capacity or funding to realise them and successfully scaled up between 2016-2023 by the United Nations Industrial Development Organization (UNIDO) and the Renewable Energy and Energy Efficiency Partnership (REEEP). The USAID-funded Pakistan Private Sector Energy (PPSE) Project was initiated in November 2020 as a country-specific PFAN programme with the primary objectives of developing investment-ready clean energy projects, enhancing the capabilities of financial institutions to assess and mitigate risks associated with clean energy investments and integrating low-carbon solutions into Pakistan’s mainstream energy market. Designed to support Pakistan’s transition to a cleaner and more efficient energy future, the project aimed to catalyse private sector investment in the clean energy and energy efficiency sectors by addressing systemic barriers such as limited access to finance, weak institutional capacities and an underdeveloped pipeline of bankable projects.

For over a decade, Pakistan has been one of the top ten nations most affected by climate change. Pakistan’s high vulnerability to climate change multiplies other risks, compounding its human and economic development challenges. Given these realities, Pakistan faces significant climate finance needs, with estimates ranging from USD 200 billion for Nationally Determined Contribution (NDC) implementation to USD 348 billion for climate-resilient development by 2030. Existing climate finance flows fall short of these needs, with only about USD 4 billion invested in climate-related activities in 2021. Private climate finance from domestic and international investors has lagged behind other countries and will be needed if Pakistan is to make up some of the financing gap. Estimates suggest that Pakistan’s domestic private sector only contributed 5% of total climate finance tracked, compared to 10% in Nigeria, 14% in Kenya and 51% in India. The availability of an investment-ready pipeline has been identified as the major barrier towards the lack of investment flow.

Given the Covid-19 restriction measures, PPSE was officially launched in a virtual high-level event on 3 February 2021. A number of outreach events were undertaken in 2021 aimed to delve deeper into the opportunities and challenges for clean energy deployment and financing solutions. The first outreach event targeted e-mobility, an under-developed sector in Pakistan and PPSE priority area, followed by regional focus events on opportunities for clean energy financing in Sindh and Punjab within PPSE’s first year.

Milestones

PPSE timeline

-

2020Agreement to launch the Pakistan Private Sector Energy Project signed

-

2021PPSE Launch event and first targeted outreach event First project onboarded and advisory services initiated

-

2022Launch of the Clean Energy Financing Task Force Design of a Private Equity Fund for Pakistan initiated

-

2023Implementation of Project Development Facility in Pakistan First financial closure for a PPSE-supported project

-

2024PPSE-supported companies reach USD 36.83 million in investment leveraged Based on the success of PPSE, groundwork laid for a PPSE follow up programme between REEEP and USAID

-

2025Dismantlement of USAID leads to stop work order two months before PPSE’s planned completion and cancellation of follow up programme PPSE concludes in March with limited resources

Scaling Up

The success of Pakistan’s energy transition depends on continued private sector investment, government support and international financing. PPSE’s efforts to create a robust pipeline of bankable projects, coupled with its initiatives to enhance the capacity of financial institutions, are essential in driving the country towards a sustainable and climate-resilient energy future.

Through a variety of outreach events, scoping studies and engagement with stakeholders, the initiative focused on key technological areas such as renewable energy, e-mobility, bioenergy, and circular economy practices, with Punjab and Sindh identified as critical regions for clean energy development.

PPSE’s progress over the first four years:

| 2021 | 2022 | 2023 | 2024 | Total | |

| Projects appraised | 19 | 25 | 27 | 2 | 73 |

| Projects Inducted | 19 | 25 | 27 | 2 | 73 |

| Investment Ask USD millions | 155.49 | 251 | 173.73 | 36.1 | 616.3 |

These figures reflect increasing momentum in private sector engagement with clean energy, as demonstrated by a growing number of projects appraised and inducted into the pipeline. Notably, the investment ask peaked in 2022 at USD 251 million, remaining robust in subsequent years.

A significant milestone in the PPSE project was the organisation of two roadshows in 2023 and 2024, which showcased the work of project developers and attracted attention to emerging opportunities in clean energy. These roadshows provided a platform for private sector players to present their projects, foster partnerships and attract investment for clean energy ventures, further strengthening the role of the private sector in the country’s energy transition.

2022

In September 2022, the PPSE pipeline consisted of 25 projects which were actively receiving advisory services, requiring total project finance of USD 406.5 million.

This data highlights a significant focus on solar energy and clean transport within the pipeline, reflecting the emphasis on these sectors as key areas for clean energy development in Pakistan. The distribution of projects across different technologies also underscores a strategic approach to diversify and enhance the country’s renewable energy mix.

PPSE Pipeline Overview

2023

By September of the following year, the active PPSE pipeline consisted of a total of 71 projects which were actively receiving advisory services, requiring total project finance of USD 580 million.

PPSE Pipeline Overview

2024

In the final year of PPSE, the active PPSE pipeline consisted of a total of 73 projects which were actively receiving advisory services, requiring total project finance of USD 616.1 million.

PPSE Pipeline Overview

Achievements and Impacts

Impact 1: Local climate finance advisory market developer and catalyst

The financial mobilisations have been driven by PFAN’s global network of advisors, consisting of technical and financial experts and transaction advisors. We carefully vet each advisor for their expertise and track record and continually enhance their skills to capacitate and nurture the local financing and advisory ecosystems.

Annual growth of PFAN’s PPSE advisory network:

| 2021 | 2022 | 2023 | Total Advisors | |

|---|---|---|---|---|

| No of Advisors | 11 | 9 | 16 | 36 |

Building the capacities of local advisory firms and experts is a cornerstone of PFAN’s service delivery. Regular trainings and capacity building over this time have focused on gender lens investment, financial modelling, blended finance, carbon finance, transaction management, investment structuring and deal closing.

Key trainings included:

• Financial Modelling

• Valuation

• Business Plan and Investment Mobilization

• Gender Lens Investment

Moreover, advisors were provided access to PFAN’s online learning hub which includes learning material to enhance the journey of raising finance for clean energy businesses.

This included:

• Basics of Raising Finance

• Type of Financing

• Equity Valuation

• Key Elements of a Successful Business Plan

Access to finance is crucial for the growth of climate businesses, and PPSE plays a key role in bridging this gap. PPSE backed businesses, with the coaching of advisors, were able to de-risk their investment requirements. PPSE connected businesses with financial institutions and investors interested in sustainable enterprises.

| 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|

| Projects presented to investors | 0 | 4 | 12 | 18 |

A significant milestone for the PPSE project was the organisation of two major investment roadshows in 2023 and 2024 which showcased the work of project developers and attracted attention to emerging opportunities in clean energy. These roadshows provided a platform for private sector players to present their projects, foster partnerships and attract investment for clean energy ventures, further strengthening the role of the private sector in Pakistan’s energy transition.

Impact 2: Creating financial sustainability for climate businesses

The timing of investment mobilisation efforts undertaken by PPSE pipeline companies was far from ideal. During the post-Covid-19 recovery period in 2022, Pakistan’s credit rating went downward and interest rate upward peaking at 23% in May 2024, which essentially required not only businesses to de-risk but also hampered their ability to offer return more than 30%.

Despite these challenges, PPSE pipeline companies were able to begin raising financing, demonstrating the resilience of the businesses on one side and the potential of Pakistan’s climate finance market on the other.

Yearly Financing Raised

| Initiative | Total funds raised (USD) |

| Pipeline | 46,343,921 | ||

| FY23 | 3,825,434 | ||

| FY24 | 33,006,343 | ||

| FY25 | 9,512,144 | ||

|

SME Accelerator |

2,543,089 |

||

| FY22 | 1,350,000 | ||

| FY23 | 323,089 | ||

| FY24 | 870,000 | ||

| Grand total | 48,887,010 |

Technology area of projects which mobilised finance

| Initiative | Total funds raised (USD) |

| Pipeline | 46,343,921 |

| Bio-fuels | 3,010,501 |

| Biogas | 1,178,571 |

| Clean transport | 14,317,356 |

| Energy efficiency and demand reduction | 71,725 |

| Solar | 20,560,333 |

| Wind | 7,030,000 |

| Other | 175,434 |

| SME Accelerator | 2,543,089 |

| Circularity | 931,130 |

| Clean transport | 1,156,959 |

| Energy efficiency and demand reduction | 105,000 |

| Solar | 350,000 |

| Grand total | 48,887,010 |

Impact 3: Increased investor confidence

PPSE formed The Clean Energy Financing Pakistan Task Force (CEFP-TF) in July 2022 to enhance the capacity of the financial sector in working with clean energy businesses in Pakistan. The task force, using the Community of Practice (CoP) methodology, brought together financial experts from various institutions.

In 2022, key events included a launch event in Karachi addressing clean energy financing challenges, an online workshop on climate finance barriers and an energy efficiency financing workshop in collaboration with the State Bank of Pakistan and the World Bank.

Throughout 2023, CEFP-TF organized six webinars and an in-person workshop, focusing on ESG financing, innovative financing instruments and international climate funds. A highlight was a seminar on “Hedging of Foreign Components in Project Finance” that addressed challenges from the State Bank of Pakistan’s restrictions. PPSE also organized a training session on “Gender Lens Investment”, which attracted significant participation from the banking sector. The task force continued to foster collaboration and knowledge sharing through LinkedIn and market data exchanges.

In 2024, PPSE advanced its efforts in partnership with the National Institute of Banking and Finance (NIBAF), offering seminars and training to enhance financial capacity. Early delays in the “Integrating ESG in the Credit and Investment Cycle” session were addressed, while multiple training sessions took place on topics like ESG financing and “Inclusive Investment.” Notable events included an investment roadshow in Karachi, a session on Pakistan’s cleantech ecosystem and a blended finance workshop in collaboration with Convergence.

| 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|

| Financial institutions trained | 3 | 21 | 20 | 19 |