PPSE Annual

Report 2023

-

PPSE in

2023 - 27.1 Total investment leveraged (USD million)

- 30.09 Projected clean energy capacity added (MW)

- 17 New projects inducted into the PPSE pipeline

- 10 Total projects which mobilised finance

- 27 Projects which mobilised finance (%)

- 32 Private and financial institutions trained

- 36 Public institutions trained

The Pakistan Private Sector Energy Project

The Pakistan Private Sector Energy (PPSE) Project, funded by USAID, implemented by PFAN, and jointly hosted by UNIDO and REEEP, achieved many milestones in 2023. Three years of intensive implementation work by the team resulted in the first investment closures for cleantech SMEs from the pipeline, ranging from various technology sectors such as electric mobility, circularity, energy efficiency, solar and wind energy.

PPSE’s goal is to raise USD 80 million for its pipeline. As of end of February 2024 the project has raised over half, thanks to a dynamic advisory network, relationship building with investors and financial institutions as well as by fostering an ecosystem that is willing, able and enthusiastic to invest in Pakistan’s climate adaptation, resilience and mitigation. PPSE continued to hold diverse trainings for the financial, public and private sectors, building capacity in clean energy financing, project appraisal and development, and clean energy infrastructure establishment.

Gender Lens Investing (GLI) was a hallmark priority of the project and GLI trainings for the entire network were rolled out on a considerable scale and Gender Action Plans were integrated into the advisory support for SMEs in the pipeline.

The foundations of technical expertise, financial tools and regulatory frameworks laid in the last year, are going to help PPSE achieve even greater impact in 2024 – so keep watching this space.

“In 2023, PPSE came of age in Pakistan as many of its pipeline projects moved from project development to investment facilitation. 2023 wasn’t a great year for the country’s economy with interest rates soaring to 22%. However, it was heartening to see projects finalizing term sheets with investors and raising the necessary capital for their needs. Moving forward, we intend to keep this momentum through accelerated dealmaking. We are looking forward to showcase our projects locally and internationally at different forums. As a legacy to PPSE, we are on the verge of establishing the climate focused Private Equity Fund to fill the missing gap in the market. I foresee 2024 to be a year full of promise and impact ahead.”

PPSE milestones

Pakistan was buffeted by economic, social and political pressures in 2023. From the devastation left in the wake of the 2022 floods to political upheaval and destabilisation, the Pakistani rupee hit an all-time low, crossing the PKR 300 mark against the US dollar. Despite these mounting challenges, which resulted in low investor appetite and risk aversion, USAID’s Pakistan Private Sector Energy Project (PPSE) raised USD 27,078,408.00 (and counting!) in investment for clean energy and circularity SMEs in our pipeline.

This was achieved by the commitment and professionalism of the PPSE team and the Network Advisors as well as the resilient and innovative spirit of the SMEs we support, which demonstrated the opportunity for accelerating the clean energy transition in Pakistan and improving adaptation and mitigation as critical responses to the climate crisis and political disruption.

Our efforts in showcasing the investments in the PPSE pipeline have contributed to shifting the investor mindset in the country and raising awareness of the importance of investing in the Sustainable Development Goals (SDGs) and the climate and sustainable development commitments of Pakistan.

PPSE is funded by USAID Pakistan, implemented by the Private Financing Advisory Network and jointly hosted by UNIDO and REEEP.

First Investment Roadshow in Pakistan Kicked-off in Karachi

Key highlight of these efforts was a high-level Investment Roadshow and Expo in Karachi in May 2023, piquing investor interest towards the pipeline through live pitching sessions, exhibits and bilateral meetings. Notable banks, financial institutions and angel and seed investors participated in the Roadshow, as well as representatives from the Sindh Government and USAID Pakistan. Read more

Watch Investment Roadshow day 1

Watch Investment Roadshow day 2

PPSE Represents at International Vienna Energy and Climate Forum (IVECF) 2023

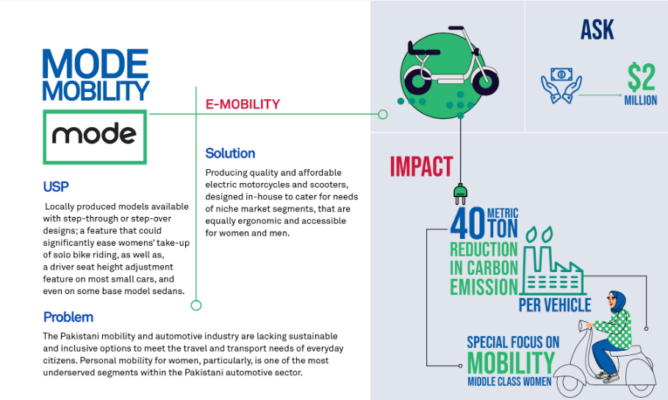

PPSE added another notable achievement on an international level. Two entrepreneurs from PFAN PPSE’s SME Accelerator’s first cohort were invited to showcase their businesses at the International Vienna Energy and Climate Forum (IVECF) 2023: Mode Mobility and Greenovation, focusing on electric vehicles and circularity, respectively. Mode Mobility joined the Cleantech Days at IVECF and won the ‘Best Youth-led Solution’ award from the Cleantech Days Pitching Competition.

Watch Mode Mobility, winner of Cleantech Days Pitching Competition, ‘Best Youth-led Solution’

PPSE pipeline overview

PPSE success stories

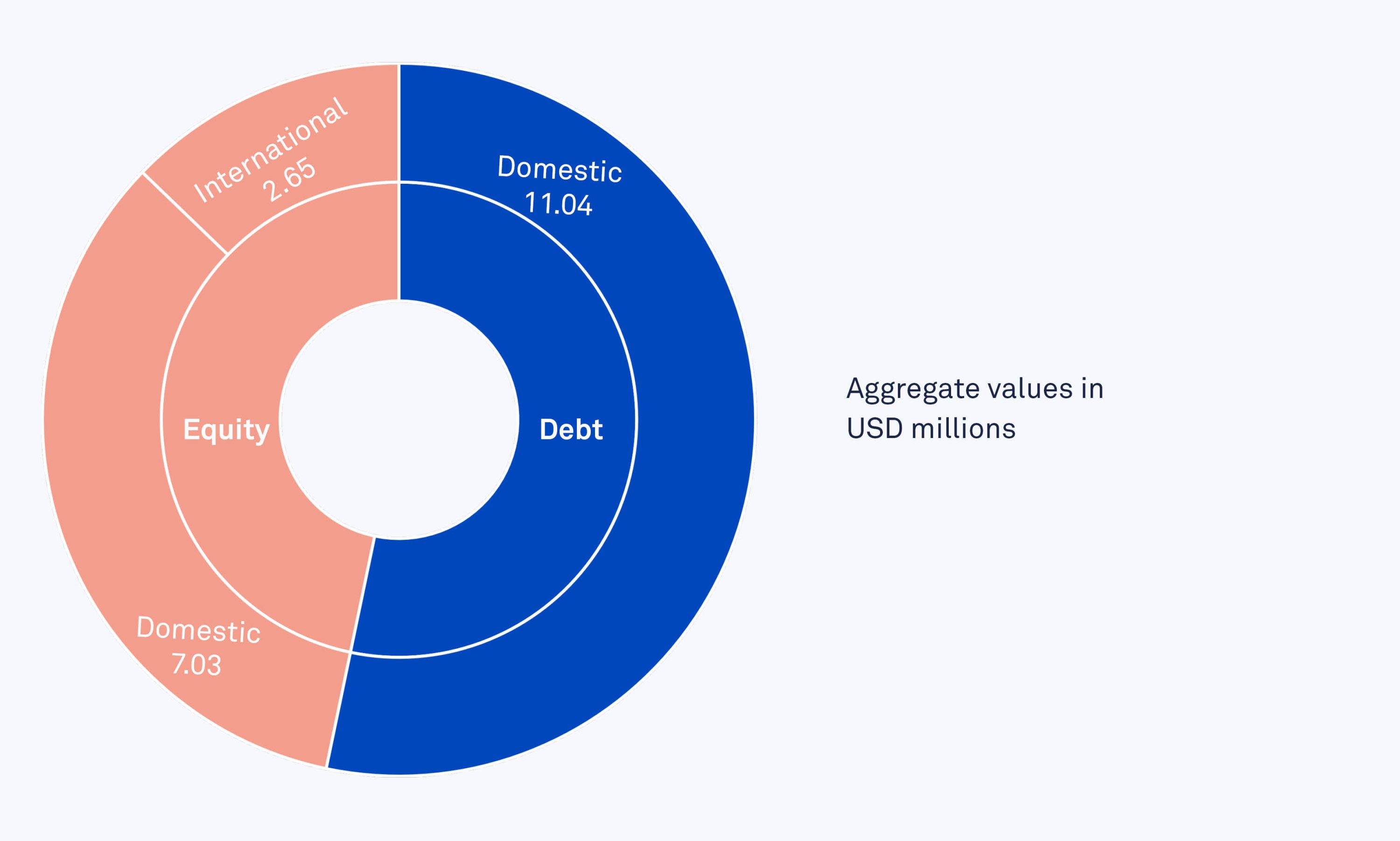

PPSE closely followed the Pakistan market in 2023 and structured transactions as debt or equity, depending on market dynamics. Our Advisors and Investment Experts structured each company’s risk profiling in a way that short-term costs could be endured for long-term environmental and economic gains. Advisors were successful in project assessments and mapping each SME’s viable approach to showcase to lenders or investors with matching risk appetites.

Financing raised by investor type (domestic vs. international) and financial instrument

Scroll below to find out more about the 10 dynamic companies from diverse technology sectors that leveraged investment in 2023 and the first two months of 2024:

Ray Data Environments

PPSE closely followed the Pakistan market in 2023 and structured transactions as debt or equity, depending on market dynamics. Our Advisors and Investment Experts structured each company’s risk profiling in a way that short-term costs could be endured for long-term environmental and economic gains. Advisors were successful in project assessments and mapping each SME’s viable approach to showcase to lenders or investors with matching risk appetites.

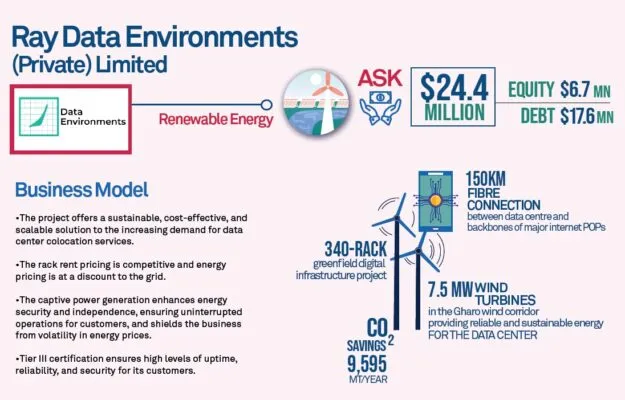

Data processing requires a vast amount of energy which is a huge problem for an energy-deficient developing country such as Pakistan. Ray Data Environments is committed to solve the dual problem of data storage and sustainable energy by establishing a renewable-powered data centre in Southern Pakistan, comprising a 7.5 MW wind farm and a 340-rack data centre. PPSE supported RDE in development of financial model and business plan. Further, under project development facility, PPSE supported RDE in achieving key project milestone regarding it’s feasibility study. With PPSE’s support the company has successfully secured USD 3.4 million in equity from a local investor and aims to raise an additional USD 3.3 million in equity and USD 17.5 million in debt for future financing for which discussions are underway.

Success Spotlight: Ray Data Environments Ltd. This company’s unique selling proposition is that is providing an innovative solution towards renewable energy needed to power the incredible volume of data.

Ghulam Rasool Company

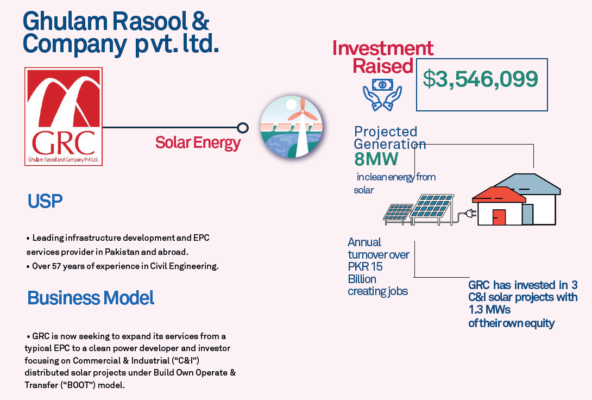

GRC is an established engineering player in Pakistan that is developing a portfolio of distributed solar power projects of up to 8MW. Their eclectic portfolio and years of project management and implementation, give GRC a competitive advantage in the market. PPSE Project Advisor worked developed the financial model and investment memorandum of the project and did the project structing. Project advisor also led discussions with the lenders on behalf of the project. Also, under Project Development Facility, PPSE offered support to the project to undertake necessary due diligence to fulfill lenders’ requirements. Together with PPSE’s support, they have raised $3,533,569 to ensure the steady scale-up of their project.

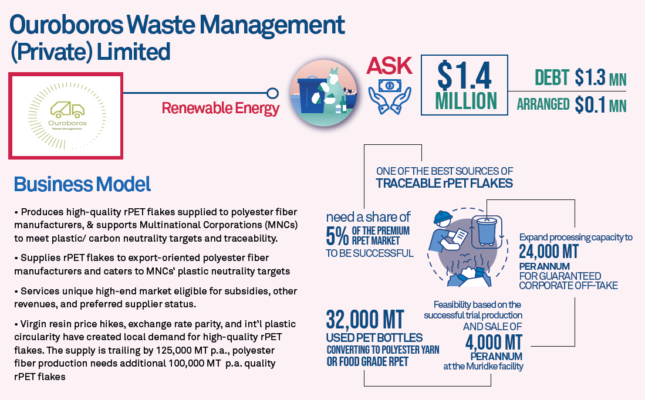

Ouroboros Waste Management

Ouroboros Waste Management Pvt Ltd is helping Pakistan’s net-zero goals by establishing itself as a leading supplier of rPET flakes to export-oriented polyester fibre manufacturers, catering to the plastic neutrality targets of Multinational Corporations (MNCs). To aid in their plans to expand their operational used bottles recycling plant, Ouroboros has raised USD 0.1 million in debt. PPSE supported the project in development of the ground up financial model and business plan. PFAN Project Advisor supported the project in investment facilitation and negotiation will the lenders.

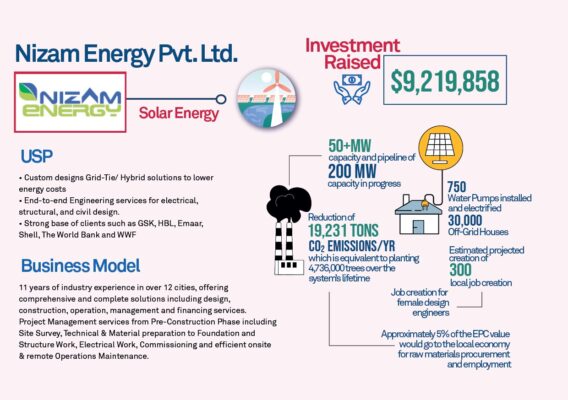

Nizam Energy

Nizam Energy’s USP lies in the efficacy of their design and engineering. They ensure a seamless shift to solar energy by engineering, procuring and constructing solar power plants competitively while ensuring appropriate selection of hardware based on the location and site conditions. They have successfully raised $9,187,279 to further scale up their operations and work towards optimal performance of solar plants. PPSE Project Advisor worked on the financial model for the project. Under Project Development Facility, PPSE offered support to the project to undertake necessary due diligence to fulfill lenders’ requirements.

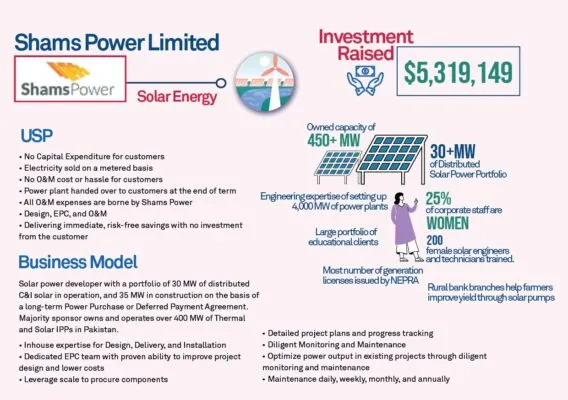

Shams Power

Shams Power is a joint venture of two of Pakistan’s leading energy companies, PITCO and Orient Operating Company, offering economically priced solar power for the next 20 years, on a Build Operate Own and Transfer basis. They enable environmentally conscientious organizations to adopt Solar PV technology by offering an all-inclusive turnkey solution. They have raised $5,300,353 in investment.PPSE Project Advisor worked developed the financial model of the project and did the project structing. Project advisor also led discussions with the lenders on behalf of the project. Also, under Project Development Facility, PPSE offered support to the project to undertake necessary due diligence to fulfill lenders’ requirements.

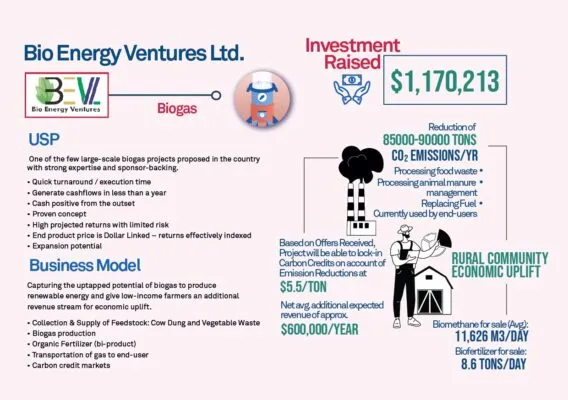

Bio Energy Ventures Ltd.

Biogas is an untapped renewable energy source with mass potential in Pakistan. BEVL is leveraging this under-explored market by establishing a biogas plant to harness economic opportunities for communities in the value chain in addition to producing natural gas. The project aims to raise clean energy access and economic status of rural communities and has raised $1,166,078 to this end. PPSE provided facilitation by providing transaction structure, refined financial model and business plan developed by PFAN Advisor. Debt structuring was also formulated in collaboration. Introduction to local and regional banks were made which culminated in negotiating with Bank Al Falah reaching financial close. PPSE also extended two PDF services to BE Venture worth US$ 46,000/- for third party audit, due diligence and verification of technology, environmental impact and feasibility and legal service.

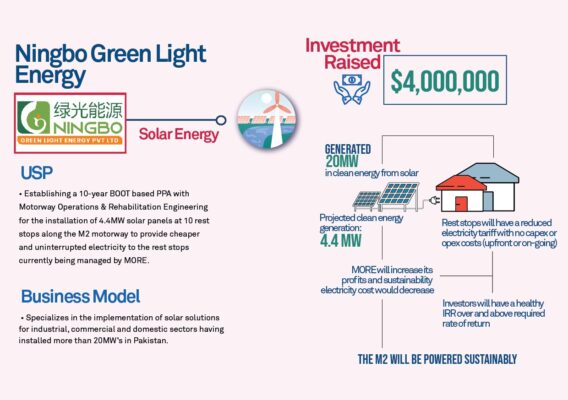

Ningbo Green Light Energy

Ningbo Green Light Energy Pvt Ltd (NGLE) aims to sustainably power rest-stops along Pakistan’s motorway by installing solar systems to provide cost-effective and energy-efficient electricity. By helping rest-stops slash overhead electricity costs, NGLE will help bolster businesses while making the country’s premier transport infrastructure greener. PPSE developed the financial model and investment memorandum for the project which helped it to raise 4 million USD in equity towards scaleup goal.

SME Accelerator companies that raised finance

PPSE understands that great change starts with an idea and building a business out of an idea takes a lot of time, expertise and effort. Small and medium enterprises (SMEs) have innovative ideas in the clean energy space but often lack guidance and resources. To amplify and support these early-stage green-companies at the SME/start-up level, we launched our first ever accelerator program in Pakistan in 2021 and in 2023 it came to fruition with accelerated companies creating a niche for themselves in the market.

Shortlisted SMEs were currently inducted in our accelerator program, delivered by the Network for Global Innovation (NGIN), an international organization with experience and demonstrated success supporting thousands of clean energy entrepreneurs in over 22 countries, including Pakistan.

NGIN’s acceleration combined with PFAN’s diverse and dynamic advisory and technical experience, the SME Accelerator in Pakistan was a unique opportunity to receive advanced entrepreneurship training, business coaching and customized support from international and local clean energy experts.

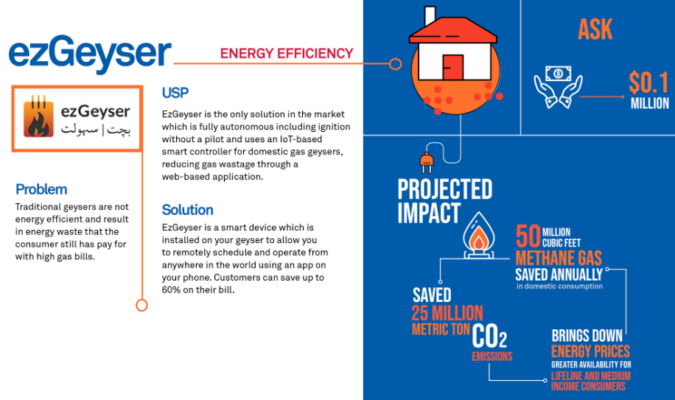

ezGeyser

Leveraging the Internet of Things (IoT), KytherTek has streamlined water heaters for energy efficient use with an intelligently designed thermostat that can be easily retrofitted to 95% of domestic geysers, allowing users to optimize their gas consumption, cut costs and reduce wastage. By implementing smart scheduling of time and temperatures, along with full automation, ezGeyser enables users to achieve remarkable gas bill savings of up to 70%. As part of the SME accelerator program, ezGeyser received investment readiness and pitch review services, supporting their growth and development, ultimately helping them secure a grant of USD 105,000 in two phases.

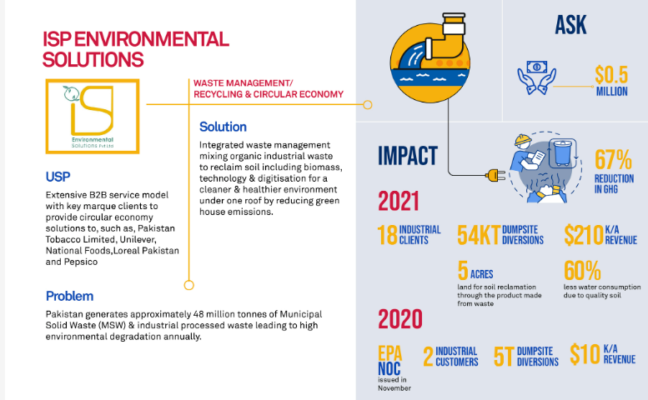

International Services Pakistan

International Services Pakistan (ISP) has been working towards creating solutions and strategies that employ Integrated Solid Waste Management (ISWM) to tackle the problem of overpopulated landfills and waste burning in Pakistan, that further contribute to health and infrastructure challenges. Armed with improved pitching skills and capacity from PFAN’s Accelerator, ISP raised USD 61,130 in liquidity from angel investors.

Mode Mobility

Mode Mobility is committed to becoming an internationally recognized Original Equipment Manufacturer (OEM) for electrified transport solutions. Part of the PFAN Accelerator, the startup has already established itself as a player to watch in the EV 2-Wheeler transport segment in Pakistan. Their main focus is to make mobility inclusive and accessible to everyone regardless of gender, age, physical challenges, and socioeconomic status. Mode Mobility raised 156,959/- USD in equity from private sector investors and is poised to raise $2 million in the next round.

Capacity building for financial institutions

“By assessing the financial needs of projects and aligning them with the current market scenario coupled with accurate mapping of financial institutions sectoral fo-cus and risk appetite, we were successful in closing a number of deals in 2023. We pursued more projects raising debt as that is the market reality currently, and we were able to keep investments afloat despite the exorbitant interest rate.”

The Clean Energy Financing Pakistan Task Force (CEFP-TF) was launched by the Pakistan Private Sector Energy Project in July 2022 in Karachi. CEFP-TF operates as a community of practice under the investment facilitation portfolio of PPSE. It is a learning and knowledge platform that brings together professionals from banks and investment and financial institutions (FIs) that are working on clean energy financing solutions and instruments in Pakistan.

Through online/in-person bi-monthly capacity-building trainings on green finance, inclusive investing and ecosystem building, PPSE in partnership with NIBAF has trained over 70 financial institutions on the following topics:

– Credit Enhancement for Clean Energy Financing in Pakistan

– Embracing equity in Pakistan’s clean energy transition

– Hedging of foreign components in project finance

– Gender lens investments and product development

– Integrating ESG in the credit and investment cycle

– ESG financing – A new era of opportunity

Capacity building for public institutions

“This year we held several effective trainings for public sector enterprises, such as on electric mobility, solar PPAs and investment facilitation by imparting the knowledge of the latest trends in investment project preparation and appraisal and utilising UNIDO’s software COMFAR for preparing investable projects. These trainings helped public sector organisations in better preparation of project and attracting more investments, especially for clean energy projects.”

While PPSE has a keen focus on the private sector, bolstering policy, public infrastructure and understanding of climate finance and green financing in the public sector is equally crucial. Building a conducive regulatory environment is imperative for clean-tech SMEs in Pakistan to thrive, and as such, PPSE has organised the following high-level trainings in partnership with private and public partners, building the capacity of over 60 public sector institutions:

– Electric mobility training with the Lahore University of Management Sciences

– Twenty-six public sector organisations in Pakistan trained on solar PPAs

Project appraisal and COMFAR trainings in Islamabad showreel

Gender mainstreaming

“Our interventions for gender mainstreaming are based on the business case for women’s greater parity but also that women’s inclusion is a basic human right. Di-versity drives innovation that is needed for the clean energy transition, and by focusing on gender lens investing this year, we have helped build more equity in the financial sector and within our pipeline.”

Gender Mainstreaming is at the heart of PPSE’s activities, as we recognise not only the responsibility but also the opportunity to contribute towards the overarching goal of gender equality and the empowerment of women. Since 2021, PPSE has been intensifying its efforts to achieve its gender objectives through various means, such as the development of a PPSE-specific Gender Strategy and Action Plan as well as Gender Awareness Trainings and Masterclasses on Gender Lens Investing.

This year, we brought investment and gender efforts together, and contextualised PFAN’s industry-leading Gender Lens Investing efforts to the cultural and socio-economic realities of Pakistan to customise content. Furthermore, our team and advisors received training on building gender action plans for SMEs through the toolkit formulated by Value for Women. Working together with selected SMEs from our pipeline: Vlektra (e-mobility) and Rapidev (energy efficiency), we aligned the Gender Action Plan for these companies with industry and country-specific needs.

Gender mainstreaming milestones

-

34% of PPSE Advisors are women

-

14% of projects in our pipeline have women ownership

- 23% female representation in the executive management of projects in our pipeline

Gender mainstreaming activities

Webinar: Women Leaders Set forth the agenda of Gender Equity in Pakistan’s Clean Energy Transition

PPSE held a multisectoral webinar with Pakistan’s women leaders, setting forth the agenda on gender equity in the country’s clean energy transition. Panelists covered diverse principles and components of the transition, from power, mobility and industries to climate finance and development. Each topic was integral to shedding light on equity issues in these sectors that need to work in tandem to build a more equal and sustainable world. Read more

102 finance and development professionals trained in gender lens investing and inclusive product development under Community of Practice

Women are the world’s fastest-growing market as more women are becoming highly educated, entering the workforce, and starting businesses. While these upward trends make women a potentially lucrative target demographic for financial institutions, in countries such as Pakistan, social and gender norms that place economic and social barriers on women abound. Thus, the potential of this market remains largely untapped and women are still significantly either unserved or underserved in Pakistan.

PPSE held a 1-Day intensive training covering the gender lens within banking products that facilitate more equitable investment, particularly in clean energy at the National Institute of Banking and Finance (NIBAF) for this capacity-building initiative. Read more

Watch the Gender Lens Investment training showreel

PPSE Webinar: Developing the Business Case for Gender Lens Investment in Banking Product Design

After the overwhelmingly positive feedback from the Gender Lens Investment Training in partnership with NIBAF, PPSE held a follow-up online demo session on: “Developing the Business Case for Gender Lens Investment in Banking Product Design”. The session was led by Fauziah Ali Banuri, Divisional Head of Marketing at Bank of Khyber.

The session took 28 participants from financial institutions and investment hubs through a gender assessment toolkit formulated by the Financial Alliance for Women.

Other gender mainstreaming milestones:

- Developed a Gender Lens Investing Toolkit for Financial Institutions

- 2 cleantech SMEs provided with Gender Advisory Services

- 3 advisors from the PPSE network trained in Gender Lens Investing and Advisory

Strategic partnership

2023 started off with a fruitful strategic partnership between PPSE and the National Institute of Banking and Finance (NIBAF). The partnership was established not only to provide unparalleled training support but also as an intellectual and expert powerhouse of trainers as well as a repository of finance professionals and institutions. As NIBAF is a subsidiary of the country’s central bank, the State Bank of Pakistan (SBP), it is the leading institute for the training of central and commercial bankers, micro and rural finance providers, and management professionals in the country.

Thus, PPSE’s cooperation with NIBAF has helped streamline trainings through each echelon of Pakistan’s finance infrastructure and regulation. From top leadership to managers and department heads, trainings under the Clean Energy Financing Pakistan Task Force (CEFP-TF) have immensely benefited from this alliance.

“What stands out about the trainings we have jointly conducted with PPSE is that they include both regulators and market experts in building capacity on sustainable finance, which is much needed to strengthen the financial sector. I am especially heartened to see their commitment to training on gender inclusion, as that is a big priority for SBP’s Banking on Equality policy.”

Meet the PPSE team

Since the inception of the PPSE Project, the team has been dedicated to carving a strong identity for PFAN in Pakistan and has been successful in establishing itself as a key player in climate finance in the country. From working closely with the private sector and strengthening clean-tech SMEs, to armoring the public sector with industry-leading project appraisal practices, PPSE in just three years has provided value in the clean-tech ecosystem and helped build Pakistan’s climate resilient infrastructure and policy.